This was posted on the Texas HHS-OIG website yesterday. Thought we would republish..

---------------------------

Ensuring Texas Medicaid dollars are spent for their intended purpose requires the OIG to work with health care professionals to prevent fraud, waste and abuse. Accurate medical and dental coding is part of that work.

The Centers for Medicare & Medicaid Services (CMS) requires each state have the ability to perform surveillance utilization reviews. The OIG’s Acute Care Surveillance (ACS) team reviews medical records to validate that the services billed and paid for conforming to the policies of Texas Medicaid and managed care organizations (MCOs). For dentists, the OIG follows the coding guidelines set forth by the American Dental Association’s Current Dental Terminology (CDT) and Texas Medicaid.

Validating Medicaid codes

To begin a coding review, the OIG’s ACS team analyzes data that includes billing patterns and payments received by dentists and other health care professionals. When identifying providers for further review, the OIG analysis also considers specialties, regional differences and patient demographics. For example, a pediatric dentist would be compared to other pediatric dentist.

To begin a coding review, the OIG’s ACS team analyzes data that includes billing patterns and payments received by dentists and other health care professionals. When identifying providers for further review, the OIG analysis also considers specialties, regional differences and patient demographics. For example, a pediatric dentist would be compared to other pediatric dentist.

Based on the data analysis, an ACS nurse reviewer will examine a case involving a dentist or practice and then request patient records to substantiate what was billed and paid. Requested records typically include but are not limited to:

- All documentation for the day of service;

- Patient complaints and symptoms;

- X-rays and intraoral photographs;

- Treatment plan, sedation records and progress notes, including prescriptions;

- Prior authorizations; and

- Referrals.

The OIG’s chief dental officer may also review the records and initial findings. An ACS nurse notifies the health care professional of the review’s findings. A case is closed without further action if patient records support the billing and payments. If billing errors are noted in a review, follow-up actions can include education and/or payment recoupment. Providers have two opportunities to appeal the findings and submit diagnostic x-rays or additional evidence.

Common mistake: Upcoding sealants and resins

The most frequent error the OIG observes in reviews is providers submitting billing codes that are not supported by patient records. In keeping with Texas State Board of Dental Examiners rule 108.8, a dentist’s notes should support everything billed for on the date of service and demonstrate medical necessity, including diagnostic quality x-rays (not photocopies).

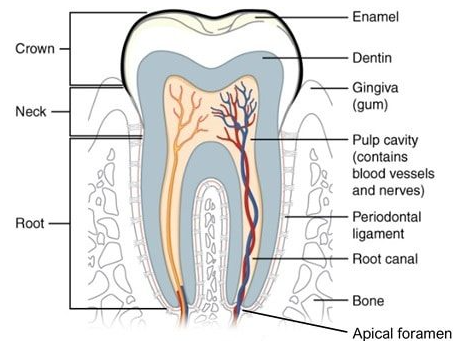

A typical upcoding error for dentists is billing for a restoration after placing only a sealant or preventive resin. While CDT defines a preventive resin restoration as “a conservative restoration of an active cavitated lesion in a pit or fissure that does not extend into the dentin,” a restoration is “used to restore a carious lesion into the dentin or a deeply eroded area into the dentin. Not a preventive procedure.” Hence, procedures billed as restorations must be for decay into the dentin demonstrated on an x-ray; simply sealing a surface to prevent decay should not be billed as a restoration.

Some dentists have told the OIG they believed their resins were of the proper depth into the tooth based on the length of a particular bur they used. However, x-rays provide the definitive information to determine whether a resin is into the dentin of a tooth, not a chosen bur, which is subject to incorrect use.

Mistakes add up

Coding errors waste taxpayer dollars and are subject to Medicaid repayment. A dental provider in Pearland billed for restorations when post-operative x-rays provided evidence that only preventive resin restorations and sealants were placed. In addition, the provider’s x-rays were not of diagnostic quality, and the provider billed for services alleged not to be medically necessary. When the case was resolved in 2021, the provider agreed to a settlement of $167,311. A dental provider in Arlington also billed for restorations not supported by x-rays. The provider worked collaboratively with the OIG regarding the documentation issues, took the initiative to improve its billing practices and internal policies, and agreed to a settlement of $13,303.

It is a dentist’s responsibility to follow the latest coding and billing guidelines. Monitor changes in the online manuals from your DMOs, the Texas Medicaid & Healthcare Partnership, and the ADA’s CDT edits.