More details have emerged about Joshua Lafountain, the relator in a Texas Medicaid Fraud Prevention Act qui tam lawsuit filed against 71 dental organizations and dentists in 2016. The case is now before a judge in Dallas County District Court.

Allegations fuel case but no evidence

As TDMR previously reported, Lafountain, in a deposition earlier this year, admitted to never working for any of those he accuses of Medicaid fraud, never going inside their offices, never talking to any of their patients, never seeing any patient charts that would lead to such allegations. He brought the case forward with no evidence of wrongdoing.

He simply alleged that these entities were committing Medicaid fraud because he worked at an office of Bear Creek Dental in Dallas, where he was the office manager, and where these dentists were employed. These dentists went on to found their own successful practices.

None of the 71 offices or dentists have ever been scrutinized by a DMO or HHSC-OIG for Medicaid fraud.

Sadly, this lawsuit appears to be using the TMFPA as a stalking horse so that Lafountain’s well-connected, contingency-paid attorneys can extract sizeable settlements from the accused due to the high cost of defending against such allegations. Unfortunately, the court and the Office of the Attorney General Civil Medicaid Fraud office have allowed this to go on.

Used office and office equipment to gamble

As reported before, Lafountain is far from credible. He has admitted under oath that he used time as an office manager at Bear Creek from which he was fired in 2012 to gamble online using office computers and even borrowed money from Bear Creek staff to cover his debts.

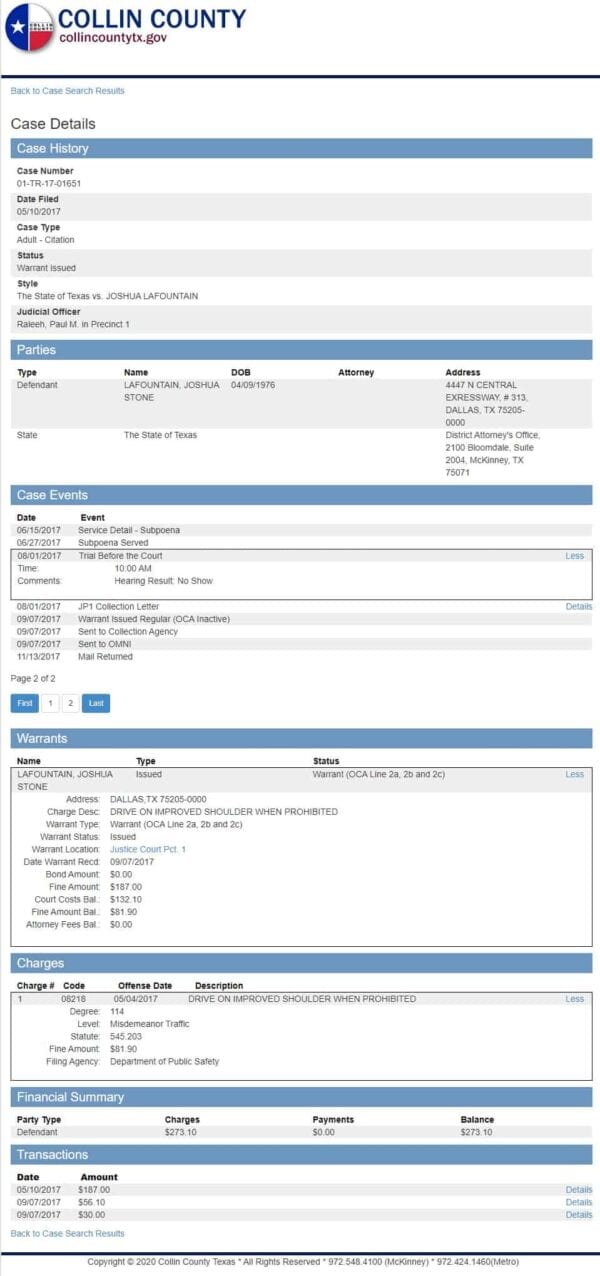

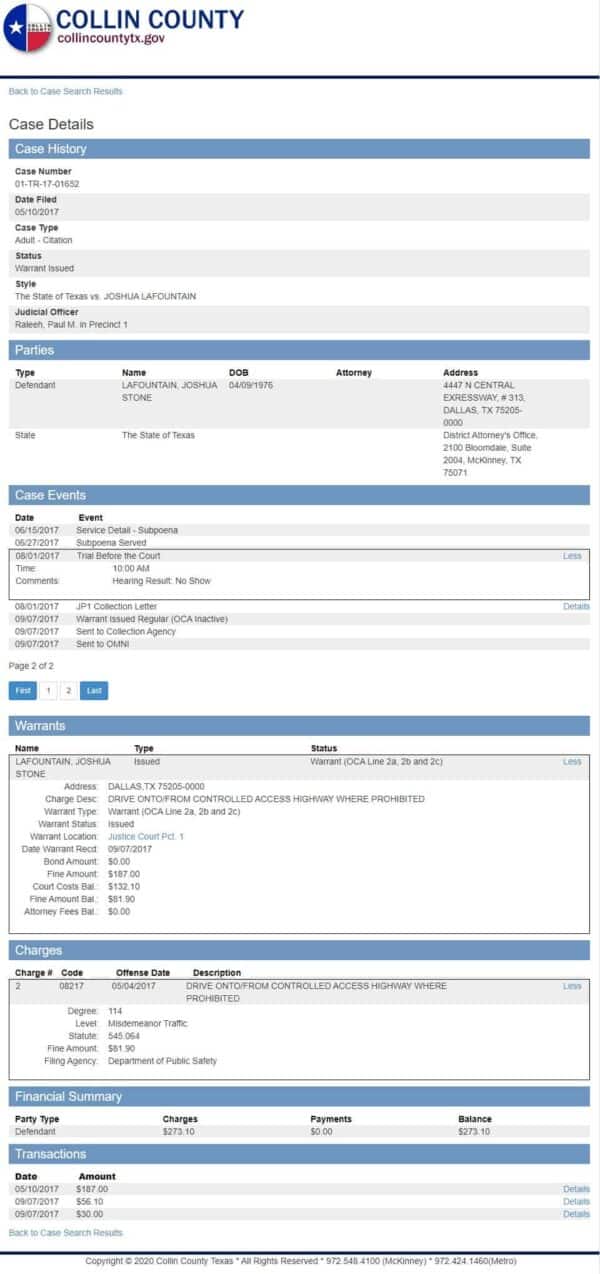

Outstanding warrants in Collin County

TDMR conducted a simple online public records background check on Lafountain who lives in Dallas.

It shows that in early 2017 Lafountain received citations for two traffic violations in Collin County. He never showed up for his court date and never paid the fines. Consequently, warrants for his arrest have been outstanding since August of 2017 even as his qui tam case was winding its way through the Dallas County court system.

Wanted in Florida for 10 years

Public records in Florida show that a criminal case against Lafountain was started in 1996 for passing a bad check. In Florida, it becomes a crime to pass a bad check if it is not made good within 15 days. The penalties can be severe.

Public records in Florida show that a criminal case against Lafountain was started in 1996 for passing a bad check. In Florida, it becomes a crime to pass a bad check if it is not made good within 15 days. The penalties can be severe.

If the value of the check is less than $150.00, it is a first-degree misdemeanor, punishable by up to 1 year in jail. If it is more, the offense is a third-degree felony, punishable by up to 5 years imprisonment.

Lafountain was sent a summons and an arraignment date was set but he apparently didn’t show. The case was outstanding until November 2017 when the statute of limitations ran out and the state closed the matter.

So all the time that Lafountain was accusing dental professionals of fraud, he was wanted for it in Florida.

State backs scofflaw

We’re not sure how a person who has outstanding warrants can be allowed to prosecute health care professionals on behalf of the Attorney General of Texas. The OAG, as TDMR has reported, even defended Lafoutain’s qui tam action against a motion for dismissal brought by defense lawyers for some of the dentists.

Surely, this is inappropriate at best. Such a practice goes against the Department of Justice guidelines for the handling of federal False Claims Act cases which calls for the dismissal of such a case.

Goes against federal guidelines for FCA cases

The Department of Justice via its director of the Commercial Litigation Branch, Fraud Section, issued guidelines in January of 2018 for its attorneys and Assistant U.S. Attorneys to use in evaluating when to dismiss qui tam actions brought under the FCA. TDMR received a copy after our previous stories on this case.

The memo, available below, states in part:

“If the cases lack substantial merit, they can generate adverse decisions that affect the government’s ability to enforce the FCA. Thus, when evaluating a recommendation to decline intervention in a qui tam action, attorneys should also consider whether the government’s interests are served, in addition, by seeking dismissal…The Department plays an important gatekeeper role in protecting the False Claims Act, because in qui tam cases where we decline to intervene, the relators largely stand in the shoes of the Attorney General. That is why the FCA provides us with the authority to dismiss cases. “

The memo outlines seven factors government attorneys should consider in deciding to dismiss a qui tam action.

The first is “Curbing Meritless Qui Tams.” The advice is: “The Department should consider moving to dismiss where a qui tam complaint is facially lacking in merit—either because relator’s legal theory is inherently defective, or the relator’s factual allegations are frivolous… In certain cases, even if the relator’s allegations are not facially deficient, the government may conclude after completing its investigation of the relator’s allegations that the case lacks merit. In such a case, the Department should consider dismissing the matter.”

Honest providers need protection by the state

Our conclusion is that the TMFPA and its administration needs to be updated to protect honest health care professionals from opportunistic individuals and law firms trying to make a dishonest buck.

Awesome reporting. Thank you so much. I am a lawyer. If I can help in any way, please let me know.

Thanks. We welcome written submissions or articles on topics relating to Medicaid that are relevant to our mission statement. If there is anything you think might help Medicaid dentists or providers in general, please send it to us for consideration for publication.